Explore

Types

Categories

- Nature

- Forest

- Plants

- Space

- Anime

- Animals

- Deer

- Panda

- Rabbit

- Lizard

- Jellyfish

- Goldfish

- Birds

- Eagle

- Flamingo

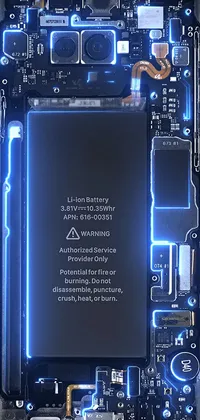

- Technology

- Cool

- Love

- Valentine's

- Flowers

- Sunflower

- Cars

- Fruit

- Lemon

- Food

- Chocolate

- Art

- Vintage

- Geometric

- Fantasy

- Vampire

- Werewolf

- Happy

- Holi

- Easter

- Inspirational

- Time

- Sports

- Baseball

- People

- Army

- Auto

- Trucks

- Music

- Insects

- Ladybug

- Caterpillar

- Cities

- Travel

- Weapons

- All Categories

Color